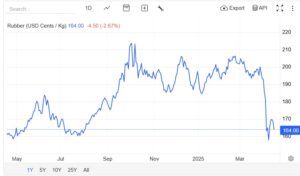

Reports say that Natural Rubber prices are on a downward slide. However, anyone who has the slightest interest in the rubber industry will know that the slide of today can turn into a hike tomorrow

Tariffs rarely have the outcome expected as we may be about to find out

NR prices are always volatile. However, maybe the drivers have changed. One of the key drivers of NR prices was the Chinese tyre industry buying rubber in huge quantities, for years in advance to ensure they had the feedstock they needed to meet the demand from their tyre industry. This was one way in which the Chinese manufacturing base could produce huge volumes of tyres at lower costs than any other manufacturing centre.

Then, along came Donald. Given what we appear to know about Donald he probably thinks even less about his tyres than the average motorist. It is unlikely that the US tyre industry is high on his list of sectors to support. Although, the US market has been under pressure from Chinese sourced tyres for some time, and sticking a 148% tariff on Chinese produced tyres will absolutely negate any price differential in the US market – this will include tyres made by leading brands such as Michelin, who also manufacture tyres in China.

Now, discussing this topic is getting Commercial Tyre Business into some shaky ground. The vacillations of Donald Trump are beyond compare. He can declare one thing tonight, and tomorrow morning it will all be different again. But let’s hypothesise on the basis that China is not going to back down, and Donald sticks to his guns.

China will potentially continue to manufacture the same volume of products tomorrow as it has done today.

The UK’s Daily Telegraph reported that UK businesses were expecting a flood of even cheaper Chinese goods coming onto the market at even lower prices than before. Great news for the consumer – perhaps. But not such great news for the retailer, or the UK/ European manufacturer of comparable goods.

This brings us to tyres and what “could” happen

The European Union has just lowered tariffs on the import of China-manufactured tyres. This against a growing market share of both PCR and TBR tyres going to tyres imported from China. The UK is still debating increasing tariffs on the same products. That juxtaposition is slightly confusing, as the EU-based manufacturers have more to lose than the limited tyre industry in the UK. Nonetheless, this is where we are.

China will, if it follows past patterns, continue to produce the same volumes of tyres post US tariffs as it did previously. China has always put a focus on exporting, and has often been accused of breaching WTO rules by subsidising exports.

The legal niceties don’t matter here, what does is the volume of tyres being produced.

According to Descartes, the USA imported 250 million tyres in 2023, it exported around 40 million – 10 per cent of those were from China. That equates to around 4 million units. It should be noted that China had been losing market share to Thailand and Vietnam amongst other producers.

It is reasonable to presume that the tariffs imposed by the Trump administration will decimate Chinese tyre imports into the b.

Those 4 million units will need to be offloaded somewhere in the interim. That could see Chinese producers needing to move volume, following their household goods and fashion houses by flooding the European/ UK markets with even cheaper tyres – negating the increase in the UK tariffs, and potentially driving Europe to review its lowered tariffs to protect European manufacturers and retreaders.

News reports show backlogs of goods previously destined for the USA creating a bottleneck at Chinese ports. If no deal is done between China and the USA, these goods will find alternate markets, as was suggested in the Daily Telegraph.

This will apply to tyres as much as it will to any other goods. If the deadlock continues, we can expect to see more Chinese tyres on the market outside the USA at whatever reduced price it will take to move the stock.

EU Imports from China

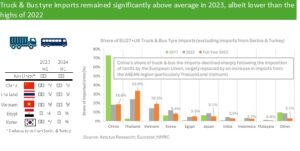

According to the most recent data from Astutus Research, in the PCR segment, China held around an astonishing 70 per cent share of the European tyre import market (EU27+UK) in 2023. In the truck sector, in 2017, the Chinese market share stood at around 70 per cent. However, in this respect tariffs had an impact, cutting their share by 2024 to around 18.6 per cent. However, this period also saw Thailand and Vietnam increase market share to 33.8 and 19.3 per cent respectively. The idea that tariffs on Chinese tyres would protect the European market was shown to be false, as the market share lost by China was simply taken up by Thailand and Vietnam.

It remains to be seen whether China will “dump” its excess stocks around he world. If it does so, then there may be no real impact upon the manufacturing output and China will carry on producing as normal, if at a lower level of profitability. If it cannot move the backlog, and it has to cut production, that may impact on NR prices as China reduces is forward purchasing to address the oversupply it will have if it is forced to reduce its output.

That drop in demand for Natural Rubber may have knock-on impacts for everyone in the future. However, our crystal ball is limited by the vacillations in the White House, and by the time this is published, the goalposts may have been moved again.