The number of UK light commercial vehicles (LCV) registered in the UK grew for the seventh consecutive month in July.

UK New Van Market Grows Again

This saw the market increase by 44.2% to 26,990 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). In the best July since 2020, registrations were also up 4.4 per cent compared with pre-pandemic 2019 volumes, a result of rising demand for new vans, pickups and 4x4s and the easing of supply chain issues constraining production.

The largest volume growth was recorded for medium-sized vans weighing greater than 2.0 to 2.5 tonnes, which more than trebled, up 227.4 per cent in the month. Registrations of the largest LCVs, weighing greater than 2.5 to 3.5 tonnes, increased by 29.3 per cent to 19,111 units and accounted for 70.8 per cent of the market registered in the month. Deliveries of 4x4s and pickups also saw growth, up 159.3 per cent and 48.3 per cent respectively, while registrations of vans weighing up to and including 2.0 tonnes were the only segment to decline, falling -40.9 per cent to 427 units.

Demand for zero emission work horses continued to grow with battery electric vans (BEVs) soaring 94.6% to 1,489 units and a 5.5 per cent market share – up from 4.1 per cent last year. 10,292 BEVs have been registered so far in 2023, an increase of 16.1 per cent year on year, although market share has decreased marginally from 5.4 per cent to 5.2 per cent in the year to date.

Mike Hawes, SMMT Chief Executive, said; “Following a solid first half, van sales have enjoyed an extremely positive month, beating even pre-pandemic levels. The challenge now is to deliver even greater EV uptake, which requires urgent action to reduce soaring energy costs and increase the provision of dedicated van charging infrastructure to bolster operator confidence and meet the unique needs of this sector. These are vital hurdles to overcome, more so given next year will see a ZEV mandate with minimum sales targets for every brand.”

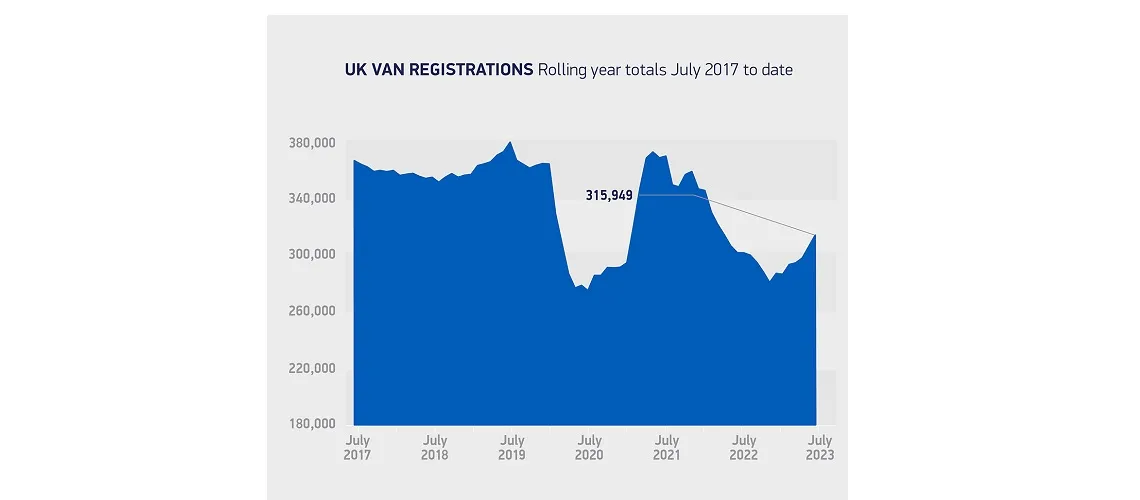

The updated market outlook foresees LCV registrations rising by 16.1 per cent to an expected 328,000 units this year, a modest rise of 0.6 per cent on April’s view, although deliveries for 2024 have been trimmed by -5.2 per cent to 329,000. While semiconductor shortages have eased, operators continue to face challenging operating conditions, including rising energy and operational costs and little incentivisation. The anticipated BEV share has also been trimmed slightly from 7.4 per cent to 7.1 per cent for this year. However, in 2024 BEVs are still expected to comprise 11.2 per cent of all registrations.