Despite the oft-discussed semiconductor shortages, the figures for November 2021 were 11.4% above pre-pandemic levels in a much-needed shot-in-the-arm for the industry, in figures released by the Society of Motor Manufacturers and Traders (SMMT).

High Uptake for Fleets Mean 2021 is Only Slightly Below Pre-Pandemic Levels

With a September recovery in the construction sector and growing business investment, especially in online retail, demand is increasing, with manufacturers battling to fulfil orders despite supply constraints.

The light commercial vehicle (LCV) market is now really starting to reap the benefits. SMMT President, Mike Hawes said of the figures, “The pre-Christmas boost to van registrations will be welcomed by the industry, but it remains a rollercoaster of a market.”

Indeed, the market remains volatile, with the stability of supply remaining a key issue, and that market volatility is likely to be a feature well into 2022.

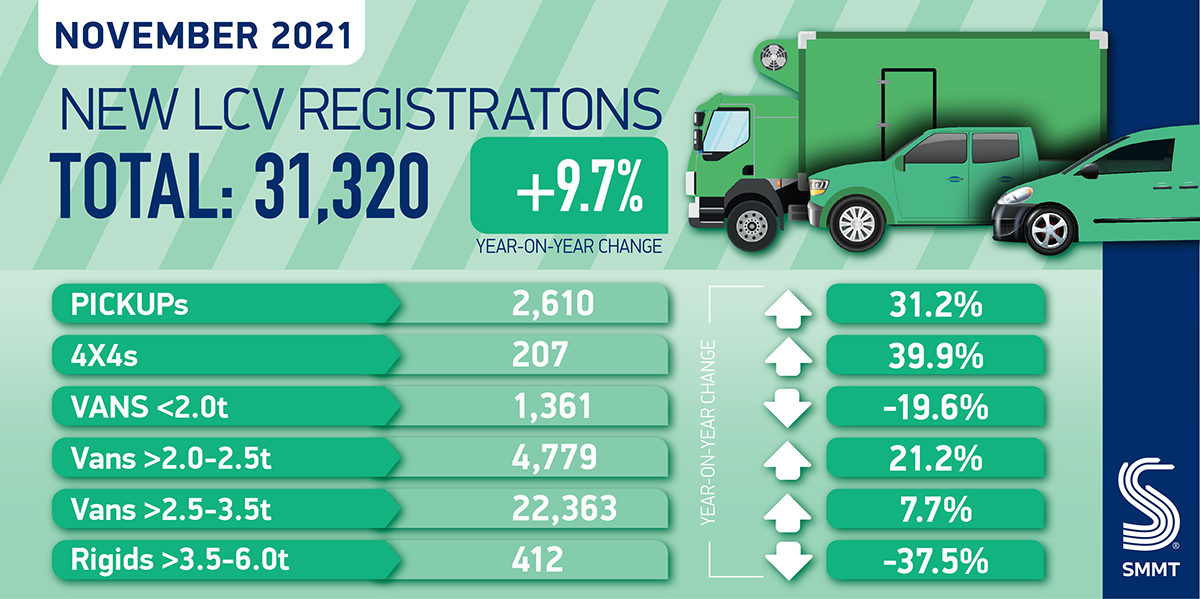

Growth was recorded in all van classes, excluding those weighing less than or equal to 2.0 tonnes, which fell -19.6% to 1,361 units. However, this weight class had enjoyed growth in previous months, indicating how this sector, with a healthy demand for delivery, has been impacted by the unpredictable supply of semiconductors. Uptake of vans weighing more than 2.5 tonnes grew exponentially by 7.7% compared to a locked-down November 2020, reaching 22,363 units, or 71.4% of the market.

Hawes added of the statistics, “Demand is robust, but market volatility is likely to remain a feature as supply chain shortages throttle the sector’s ability to fulfil orders. Manufacturers are working hard to try and overcome these shortages, with the November deliveries illustrating the success they have been having in the UK. Whilst the outlook remains challenging, customers can be reassured that the industry’s commitment to the commercial vehicle sector, given its importance to the operation of society and business growth.”

The market is now up 22.8%, against 2020’s figures, although the SMMT imagine that market growth into next year will depend not just on the supply side but demand factors too. This will be reliant on the strength of the economic recovery, with rising levels of taxation and inflation, plus the ongoing impact of the pandemic with the emergence of new variants. However, despite the likely disruption ahead, the expectation for the LCV market is a return to pre-2019 levels in 2022, indicating the elasticity of the market’s recovery and the clear demand for LCVs on UK roads.