The LCV market has seen 17 consecutive months of growth, with volumes rising by 1.9%. This growth is driven by midweight vans, marking the best May since the record-breaking year of 2021. While the uptake of battery electric vehicles is increasing, the market remains below target.

UK LCV Market Achieves 17th Month of Growth in May, Registrations Up 1.9%

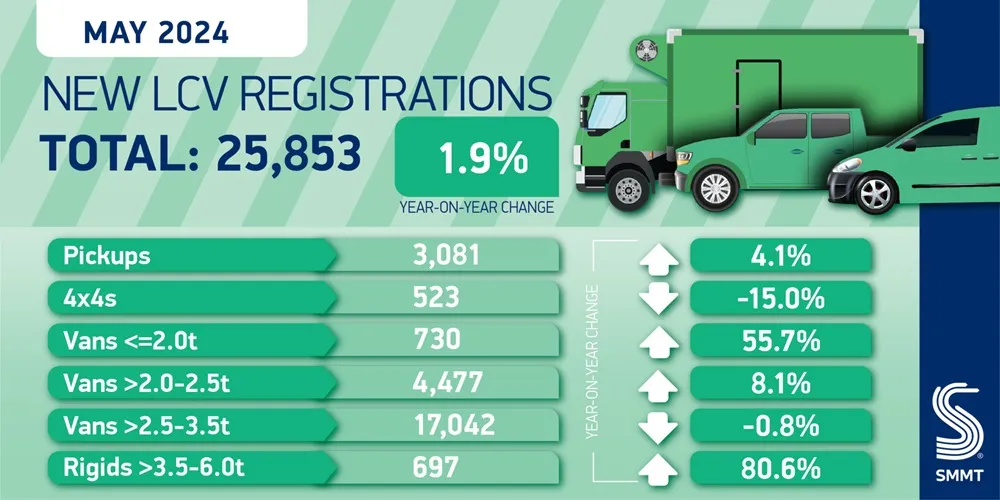

The UK’s new LCV (light commercial vehicle) market posted its 17th consecutive month of growth in May, as registrations rose by 1.9% to reach 25,853 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The result was the strongest performance for the month since 2021, which recorded the best May market in history when business investment in commercial vehicles accelerated in the wake of the pandemic.

Volume growth was fuelled mainly by an 8.1% increase in the uptake of vans weighing more than 2.0t up to 2.5t. Light vans weighing less than 2.0t recorded the largest proportional growth, of 55.7%. However, the market segment is subject to volatility arising from low volumes. The 4×4 market, subject to the same small volume variations, recorded a decline of -15.0%, while pick-ups grew by 4.1%. As ever, large vans weighing more than 2.5t up to 3.5t comprised the vast majority of the market (65.9%), with a slight decline of -0.8%.

Positive Market Trends Amidst Slow Electric Vehicle Adoption

The overall market continues to be positive, with registrations for all vehicle segments up in the year to date, and the transition to zero-emission vehicles is also keeping up – but not at the pace required to meet mandated Vehicle Emission Trading Scheme targets. Battery electric van (BEV) rose 3.5% in May to achieve a 4.2% market share – almost unchanged from last year’s 4.1%. In addition, the overall BEV uptake year to date has fallen by 2.1%, delivering a 4.8% market share, down from 5.2%. This year, the Vehicle Emissions Trading Scheme target for each brand is 10%.

Harnessing the sustained growth in LCV demand but converting more operators to go electric will be crucial to the delivery of net zero. With a choice of more than 25 zero-emission models now available to suit a variety of use cases and compelling offers available, manufacturers are making massive investments in this transition. With Britain heading to the ballot box next month, however, all parties must plan to put in place measures to help UK businesses go zero-emission by sustaining existing fiscal incentives for electric and hydrogen vans and ensuring the provision of van-specific charging infrastructure.

Mike Hawes, SMMT Chief Executive, said, “The UK van market’s 17-month run of growth is playing a crucial part in renewing the fleet with the latest, cleanest vehicles. However, convincing businesses that now is the time to switch to zero-emission operations remains a challenge. With an expanding choice for every use case now available, the next government must take steps to recharge the zero emission van market, an essential part of the net zero economy every party wants.”