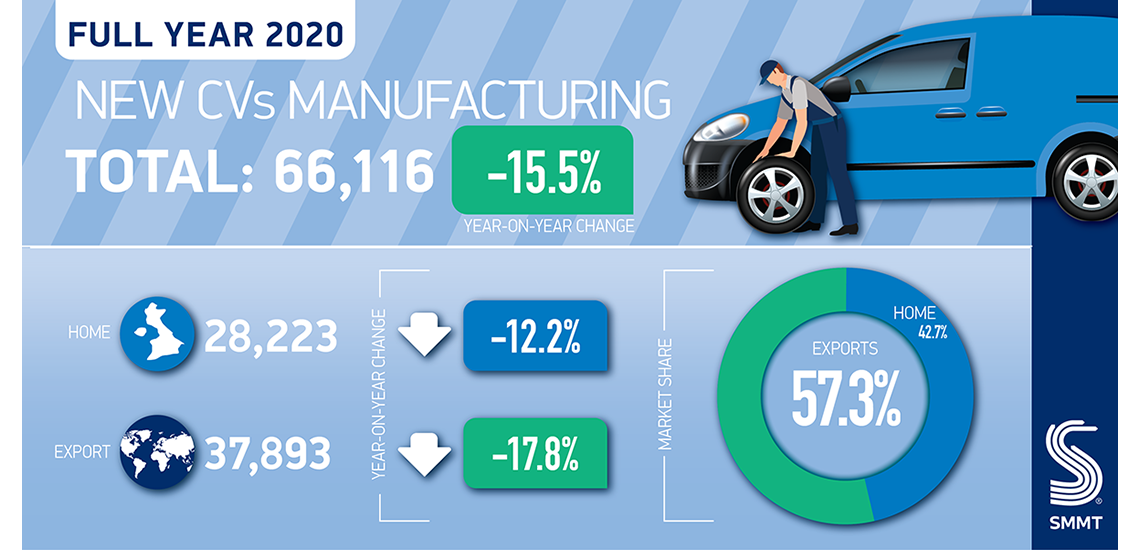

British commercial vehicle production falls -15.5% in 2020 to just 66,116 units, the lowest annual output since 1933. Output for overseas markets down -17.8%, while production for the UK drops -12.2%. More than half (57.3%) of all British-built CVs destined for global markets, underlying the importance of frictionless trade.

COVID-19 Cuts Commercial Vehicle Production in the UK

UK commercial vehicle (CV) manufacturing declined -15.5% in 2020, with just 66,116 vans, trucks, taxis, buses and coaches leaving production lines, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT). December output was down -9.2%, rounding off a weak quarter and awful year for the CV sector which turned out 12,154 fewer units than in 2019. The coronavirus pandemic, with social distancing measures and multiple lockdowns throughout the year, badly affected manufacturing capabilities and demand, while uncertainty right up until the end of the Brexit transition period dented business confidence.

These issues meant production for both the overseas and domestic markets declined, down -17.8% (at 37,893) and -12.2% (at 28,223) respectively. Nevertheless, almost six out of every 10 commercial vehicles built in the UK in 2020 were exported, with the key market, the EU, placing the majority of orders for British-built CVs (94.9% export share). While the EU was by far the sector’s biggest overseas customer, 670 units were exported to Israel, 288 to Taiwan, and 248 to Russia, as well as exports going to more than 50 other countries.

Mike Hawes, SMMT Chief Executive, said, “2020 challenged commercial vehicle manufacturers beyond belief and, as the final figures show, reflect what has been the worst year in a lifetime for the sector. The pandemic hit markets across Europe while prolonged uncertainty threatened business confidence at home, as a potential ‘no deal’ Brexit loomed over the industry for much of the year and was only put to rest on Christmas Eve. However, with the vaccine rollout now in full swing and the necessary clarity businesses need for cross-channel trading requirements now visible, there is hope for the future.”

“2021 must be focused on recovery and growth for commercial vehicle manufacturing. This starts with providing the right conditions to both attract investment and accelerate the take up of alternatively fuelled vehicles – a crucial next step on the way to a rapid and successful sector transition in the UK.”