New LCV registrations rose 8.3% in the best September in four years, but BEV uptake dropped -0.5%, marking the sixth decline in 2024. The sector urges extended Plug-in Van Grants and mandated van-suitable charging infrastructure to meet zero-emission targets.

SMMT Reports Demand for New Vans Rises in September, But EV Uptake Falls Again

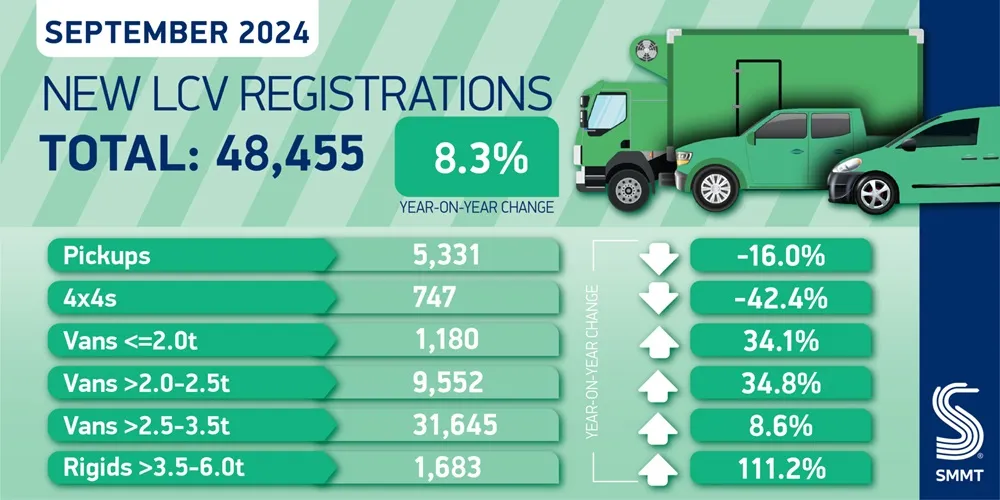

Britain’s new light commercial vehicle (LCV) market grew for the second month running in September, up 8.3% to record the best performance for the month in four years, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

SMMT reports Some 48,455 new vans, 4x4s and pickups were registered as more businesses invested in fleet renewal than any month this year, bar March, encouraged by the introduction of the new ’74’ number plate. This means 267,339 new LCVs have joined UK roads this year, up 3.6% in 2023 and has the largest January-September volume since 2019.

Growing demand for the smallest vans continued, rising by 34.1% to 1,180 registrations. In comparison, deliveries of new medium-sized vans increased by 34.8% to 9,552 units. The largest models remained the most popular, up 8.6% to 31,645 units, accounting for more than a sixth (65.3%) of the market. The SMMT report indicates Fewer pickups and 4x4s were joining the road; however, down -16.0% and -42.4%, respectively, to 5,331 and 747 units, following solid demand last year.

BEV Van Demand Falls Again Amid High Costs and Charging Hurdles

Despite the overall robust market growth, new battery electric van (BEV) registrations fell slightly, by -0.5% to 3,020 units, making September the fourth successive month of falling BEV demand and the sixth month of decline across 2024. This means 14,188 new BEVs have been registered since the start of January, -7.7% below the same period last year.

Despite significant manufacturer investment in offering more than 30 different BEV models that are widely suited to the needs of UK businesses, the greenest vans represent just 5.3% of all new LCVs registered so far in 2024—just over half the 10% required by the UK’s zero-emission vehicle mandate.

Decarbonisation will only be possible if fleet operators are confident that the switch is commercially viable. However, global economic challenges in recent years mean BEVs remain stubbornly more expensive to source and produce and, despite compelling offers, more costly to buy. The need for chargepoint infrastructure, particularly those suited to vans’ specific needs, also presents a major barrier for fleet operators considering the switch.

Vehicle Makers Urge Chancellor for EV Incentives and Charging Infrastructure

SMMT and 12 major vehicle manufacturers have today written to the Chancellor calling for measures to help speed up the pace of the consumer and business EV transition, including:

- Maintaining and extending, beyond 2025, the important Plug-in Van Grant;

- Equalising VAT on public charging to match the 5% home charging rate;

- Mandating infrastructure targets to support those who cannot charge at home and with provisions for the additional size and power requirements of zero-emission vans.

Mike Hawes, SMMT Chief Executive, said, “Growing overall demand for new vans is encouraging as the sector, a barometer of the UK economy’s health, continues to recover post-Covid. But while manufacturers have invested huge sums delivering zero-emission technology and incentivising its sale, consistently low demand is constraining industry from meeting Britain’s ambitious zero emission vehicles sales mandates.”

“For van fleets to go green at pace, they need the immediate encouragement – and long-term certainty – of fiscal incentives and van-specific charging infrastructure. Without these, UK decarbonisation ambitions cannot be achieved at the world-leading speed demanded by regulation.”