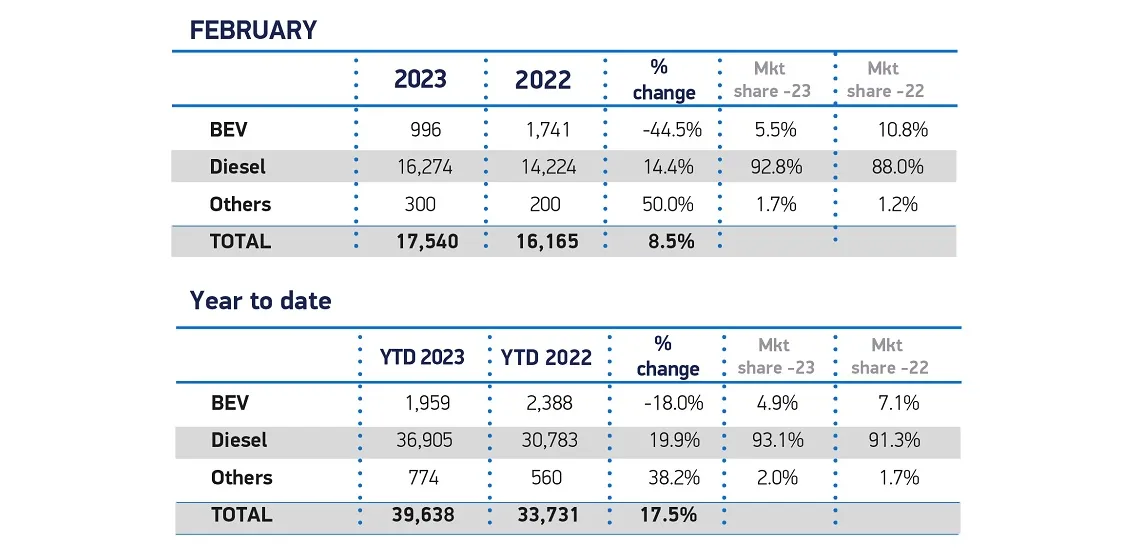

The UK new light commercial vehicle (LCV) market grew for the second consecutive month in February, rising by 8.5% to 17,540 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

UK Van Market his 25-year High in February

While February is traditionally a volatile month due to small volumes as many operators delay procurements until March and the new number plate, the increase marks the best February performance since 1998, the year before the bi-annual plate change was introduced.

Registrations of vans weighing greater than 2.5 to 3.5 tonnes rose by 14.0% to reach 12,125 units, more than two thirds of the total market (69.1%), while vans weighing up to and including 2.0 tonnes increased by 5.2%. Conversely, medium-sized vans weighing greater than 2.0 to 2.5 tonnes fell by -16.5% to 3,361 units, reflecting the broader long-term trend towards larger units. The smaller volume pickup and 4×4 utility segments both saw double-digit growth, up 42.3% and 90.8% respectively.

Deliveries of battery electric vans, meanwhile, declined to 966 units, down -44.5% on a particularly strong February in 2022, with traditionally smaller volumes in the month accentuating natural fluctuations in fleet investment. With more new models set to hit the market in the coming months, growth is expected to resume, with the latest market outlook anticipating electrified van registrations to rise by 64.5% to some 28,000 units this year. Long-term growth to meet net-zero ambitions, however, will depend on a strong, flexible market and dedicated infrastructure, which is so far lacking.

Year to date, overall LCV registrations are up by 17.5% on the same period in 2022 and by 5.3% on the first two months of 2020, pre-pandemic, reflecting demand for these critical vehicles from key sectors.

Mike Hawes, SMMT Chief Executive, said; “Following a torrid 2022, the UK van market is returning to sustained growth that is exceeding even pre-pandemic levels. Given the importance of vans to keeping the British economy and society on the move, this growth is good news. With the BEV market still in a very early stage, however, a concerted effort by all stakeholders to accelerate van-suitable chargepoint installation must become an urgent priority, enabling long-term net-zero fleet investment at the scale necessary.”